BID3 Key Functionality

BID3 provides a wealth of functionality, allowing users to simulate simple electricity systems, all the way through to complex mixed-integer or capacity expansion problems. Whether you want to run a simple simulation, carry out nodal studies or co-optimise hydrogen or reserve, BID3 has it covered!

The Dispatch module is where the detailed calculations are carried out in BID3, and allows you to simulate the most detailed aspects of markets down to a 1 min resolution

The Dispatch module is typically used to simulate a day-ahead market, and allows you to simulate every single power plant, demand, fuel and interconnectors in great detail

- Thermal plants are represented in depth, with key functionality like start-costs, minimum stable generation (min gen) and minimum on/off times

- Combined heat and power (CHP) plants can be modelled with their heat loads, backup boilers, and the relationship between heat output and electricity output

- Storage, such as batteries and pumped storage are modelled with efficiencies, and reservoir sizes

- Demand side response (such as flexible demand or electric vehicles charging) is covered in depth, with load shifting, load shedding and energy recovery all possible, allowing you to model all aspects of a future flexible system

- Sub-hourly modelling allows you to model at resolutions of 30mins, 15 mins, 5 mins or down to 1 min

The Dispatch module allows both faster Linear Programming runs, or more accurate Mixed Integer runs. Either way, it gives excellent accuracy

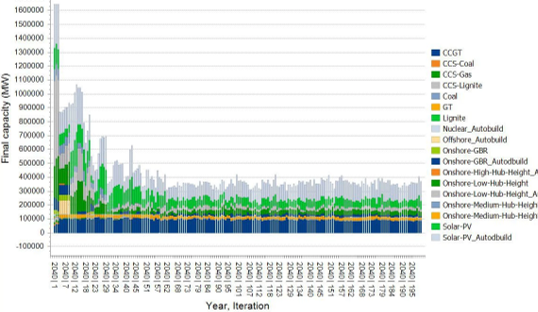

Scenario building is made easier with the powerful Auto Build module

The Auto Build is the BID3 capacity expansion module, allowing you to let the model do the heavy lifting to decide what technologies should be built, retired or mothballed in the future

- This could be as simple as getting the model to decide how much renewables is needed in the future, choosing between wind and solar as to which is most economic.

- Alternatively, you can get the model to optimise all technologies, from gas fired CCGTs and peaking plant, through to battery storage or pumped storage

- The model will also optimally build interconnection, for example deciding optimally between building storage or interconnection to relieve excess renewable generation

- Finally, if that isn't enough, you can also Auto Build hydrogen infrastructure, allowing you to investigate the optimal amounts of hydrogen storage, pipelines and electrolysis

What makes the Auto Build unique is the close match between the Auto Build results and the results of the main Dispatch runs. We don't take short cuts like simulating load blocks or using LCOE

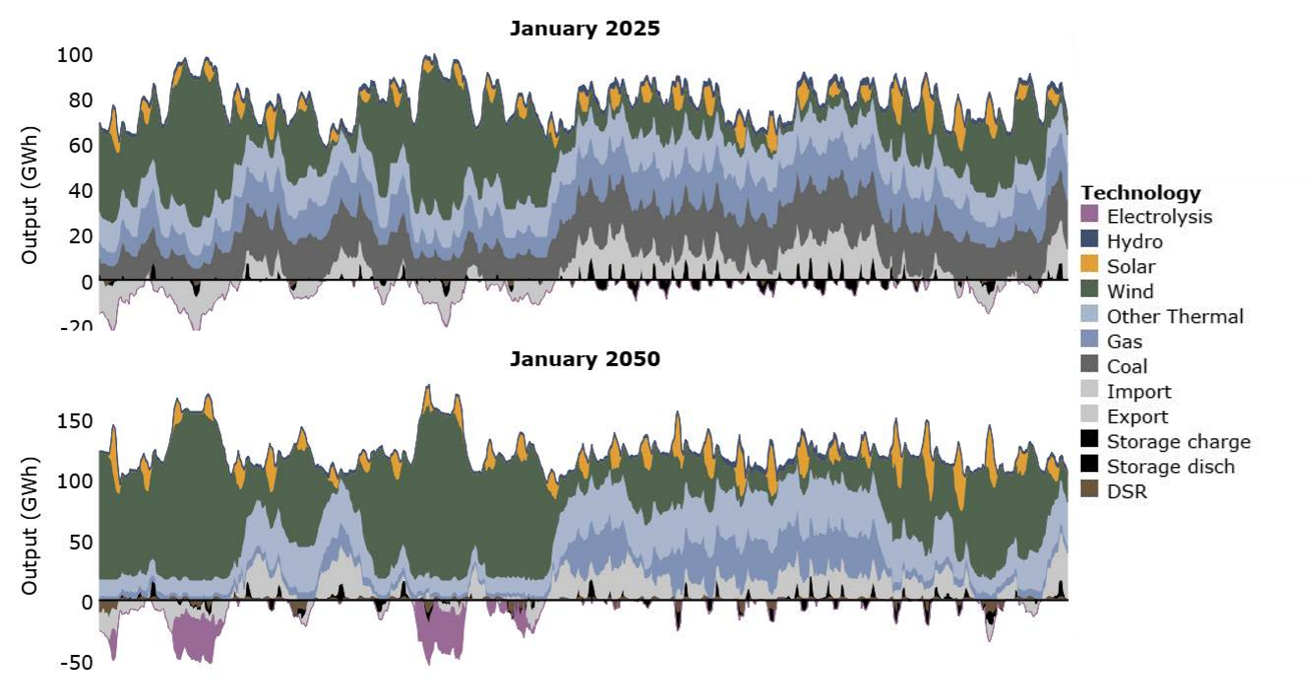

BID3 has been designed to simulate markets with growing renewables, meaning complete consistency in the weather patterns and accurate weather modelling

In all markets worldwide, renewable technologies such as wind and solar are growing in importance. In turn this means that future simulations must incorporate the weather accurately

- BID3 ensures consistency between your hourly profiles of wind, solar, demand, heat, ensuring that the simulations also contain feasible and realistic data

- Historical hour weather data is baked into the approach: so your weather patterns between countries are also consistent

- Model multiple weather patterns with ease

- Adapt your simulations to take account of climate change

Modelling a single weather pattern always seemed risky to us, but with BID3 we model 10 weather patterns as standard, ensuring we capture a wide range of weather systems

There's nothing worse than a scenario that doesn't make sense! BID3 is designed to ensure your scenarios are consistent, with all new build making a return on capital

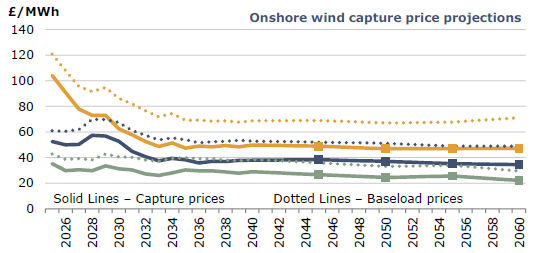

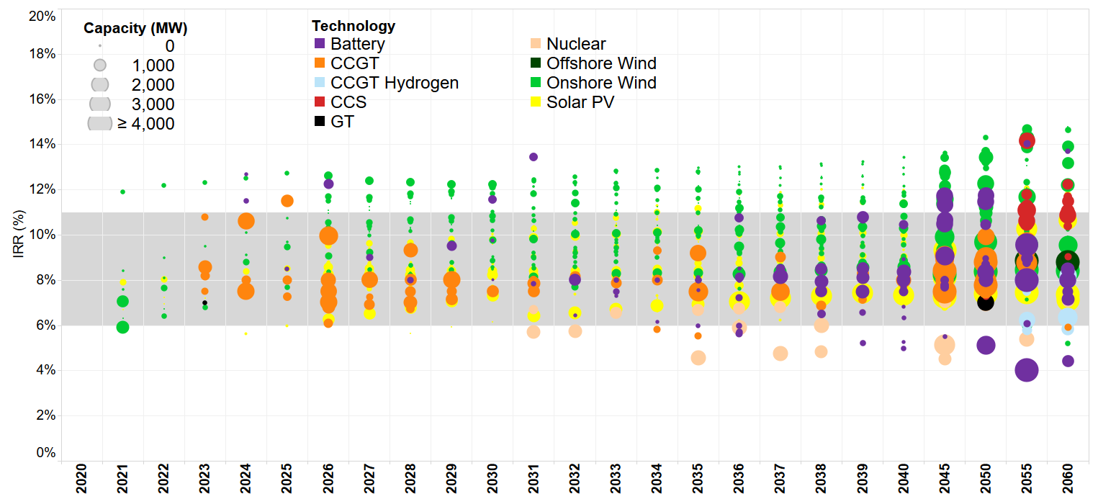

A perennial difficulty in scenarios is ensuring that all new generation covers its costs and makes a return on capital. A scenario with vast amounts of new renewables (or thermal plant) is only consistent if those plant make IRRs above their hurdle rate.

- BID3 has a dedicated Profitability module, which quickly and automaticaly calculates gross margins, IRRs, NPVs and other metrics for existing and new plant

- Any scenario you run you can quickly see if it is plausible: if your brand new nuclear plant makes a heavy loss, or your battery are making super-normal profits, you can decide if that's appropriate or not

- The model will calculate IRRs on investments you decided not to make: meaning you can see whether your decision to build (say) wind would have been better as solar

The ability to immediately understand the economic consistency of scenarios makes BID3 uniquely powerful, avoiding the pitfalls of other models

BID3 was borne as the offspring of a thermal model combined with a hydro scheduling model. As a result, it preserves the best of both worlds

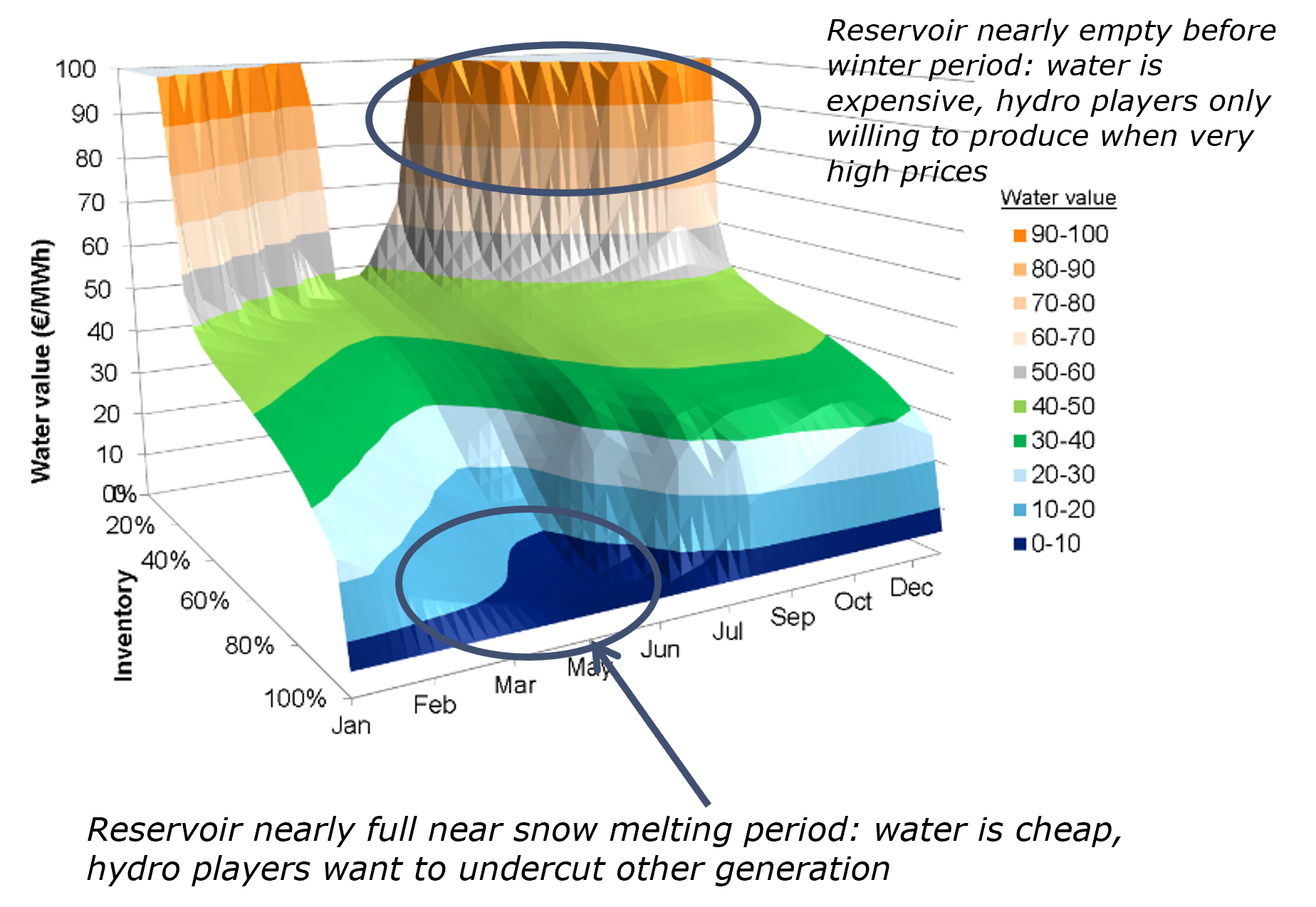

Hydropower dominated systems, such as those in the Nordics, Brazil or New Zealand, have very different dynamics to thermal systems as the value of water in the reservoir (the 'water value') is critical to the dispatch of hydro and price shapes. BID3 allows effective modelling of these systems using cutting edge algorithms

- Water value approach. Using dynamic programming techniques, BID3 can create a water value curve, showing how hydro assets would bid at different times of the year, based on their own filling levels and the filling of other reservoirs

- Cascades. BID3 optimises the flow of water from one dam to another, allowing full chains of hydro systems to be modelled

- Advanced functionality allows the model to cope with snowpack adjustments

- Fully optimised hydro. For markets with lower amounts of hydro, BID3 can fully optimise hydro production

One of the key components of BID3 is sophisticated hydro modelling that simulates the way hydro is priced and matches the operation in the market

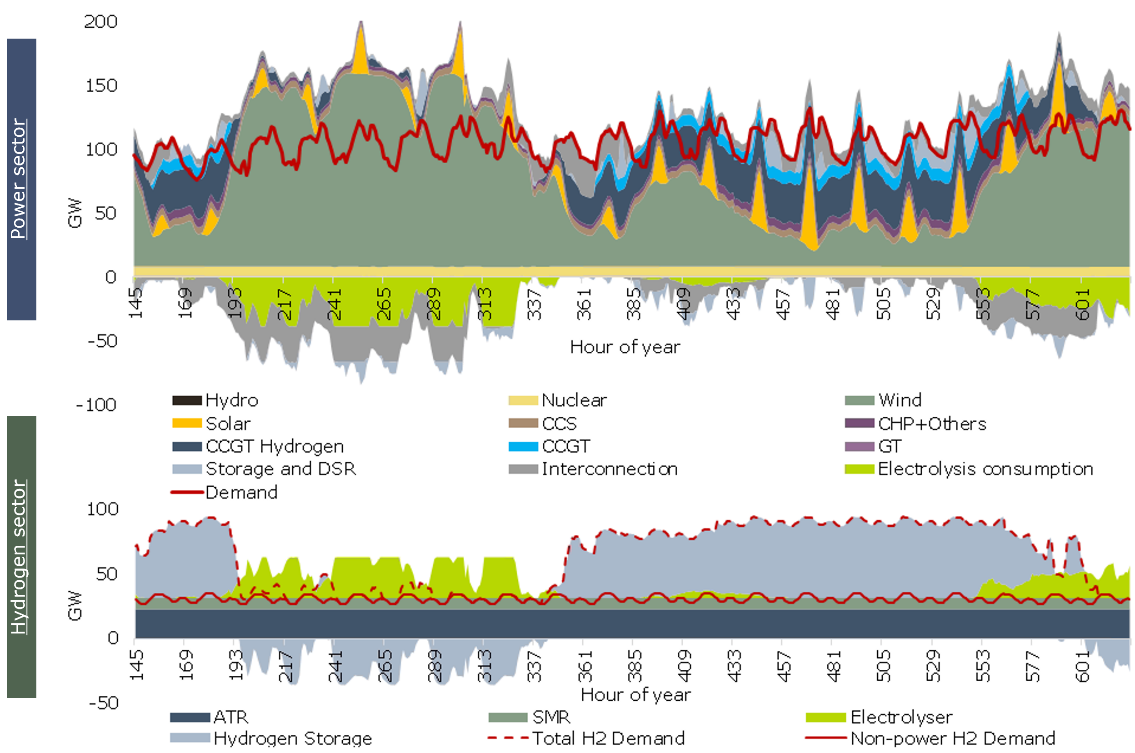

Hydrogen infrastrastructure may be one of the solutions to how to balance a higher renewable system, and BID3 allows you to model all aspects of this future fuel

Co-optimisation of hydrogen may sound complex, but it means that BID3 can optimally schedule a system to meet both electricity demand and hydrogen demand at the same time. This allows the model to simulate detailed dispatches of both power and hydrogen systems

- All aspects of hydrogen generation can be simulated, including electrolysis and SMR CCS (Steam Methane Reformation with CCS)

- Hydrogen pipelines and storage can be added to the model

- Hydrogen demand is either an input (such as industrial demand), or optimised within the model (demand from hydrogen CCGTs or GTs)

- The model decides how best to meet hydrogen and electricity demand using all infrastructure available. It may choose to use renewables to generate hydrogen via electrolysis, store it, and then use in a H2 CCGT, for example

- Hydrogen infrastructure can be built in the Auto Build, allowing the model to determine how much electrolysis, pipes, storage and hydrogen generation to build

- The same functionality for hydrogen can be used for heat or for water co-optimisation too!

Being able to co-optimise power and hydrogen means we can explore a future 100% renewable system, with hydrogen providing seasonal flexibility

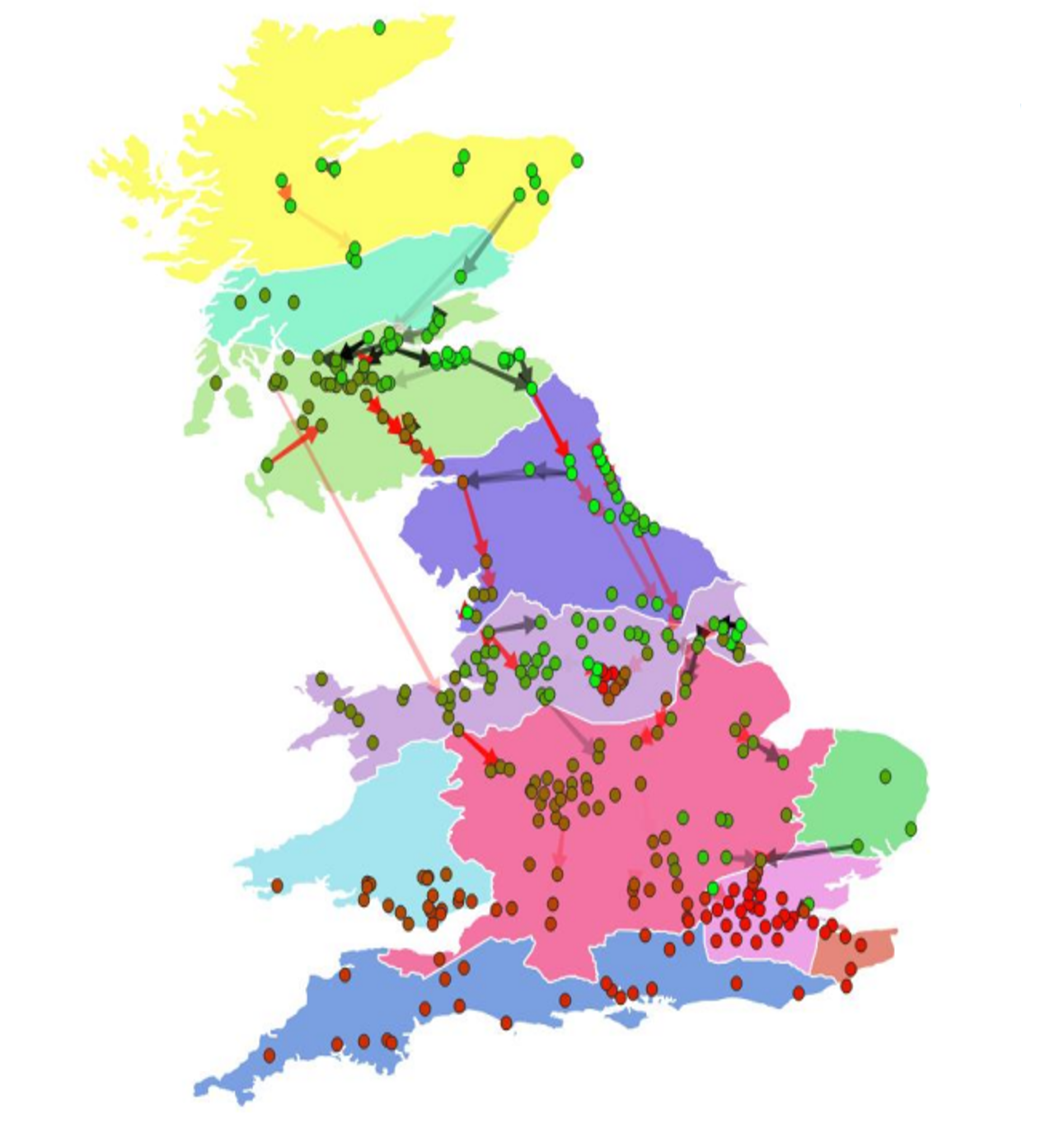

BID3 can simulate the complexities of nodal markets, including N-1 constraints. Alternatively zonal markets using NTCs or PTDFs are also modelled

Nodal markets using DC load flow approximation are an effective way of including transmission line limits in a market schedule. BID3 can switch between simulations using nodal modelling approaches or simpler NTC approaches, depending on the market

- Modelling at a price area, hub or node aggregation

- Reactance, phase shift and phase shifting transformers included

- PTDF matrices calculated as part of the nodal simulation, or can be input from external sources

- N-1 constraints fully respected or lines can overload thermal ratings in the case of a contingency

Nodal modelling allows us to understand how the prices on our nodes may evolve, and what the risks of competitive investment may be

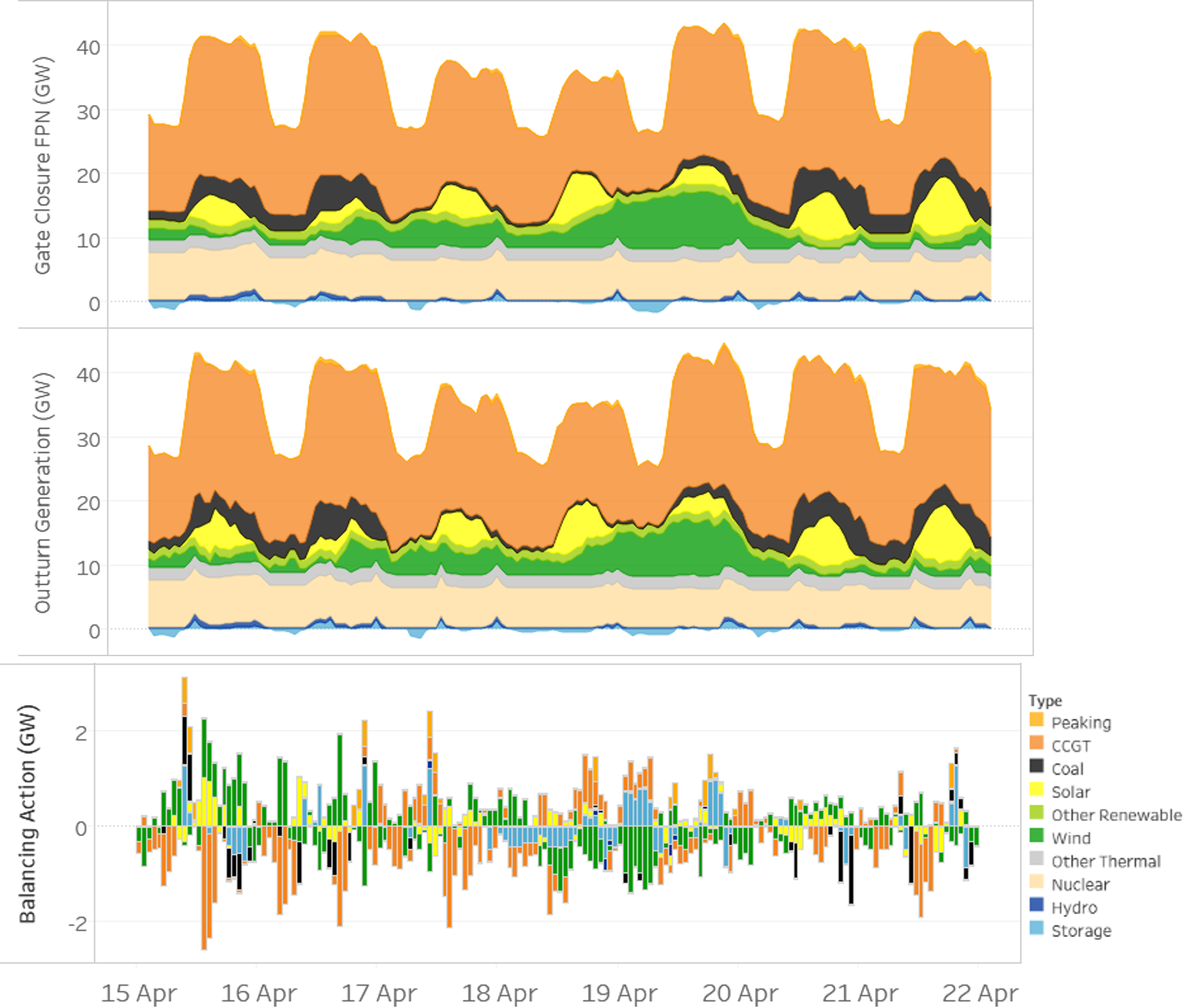

BID3 allows all types of flexibility to be modelled, and is equally effective looking at reserve markets and re-dispatch

Future energy systems will need lots of flexibility, from battery storage, hydrogen, peaking plants, and demand-side response such as Electric Vehicles. These technologies will form part of day-ahead schedules, as well as being available for reserve provision and activation in balancing markets.

- Reserve modelling. BID3 can simulate the holding of all types of reserve, including inertia and primary/secondary.

- Redispatch. By applying forecast errors, BID3 can model how intraday or balancing markets may change behaviour over time, as different plants are redispatched to meet unexpected changes in the system

- Transmission constraints. BID3 can redispatch plant to avoid transmission constraints, either in zonal or nodal systems

Using the Redispatch module and reserve modelling allows us to accurately capture the revenues for batteries from transmission constraints and from reserve provision

Adequacy assessment is the study of whether the 'lights will go out'. Is there enough capacity on the system to cope with extremes?

BID3 has a dedicated module to examine adequacy in depth. Called the LOLE module (Loss of Load Expectation module), it accurately carries out thousand of stochastic simulations, looking at the risk of plant outages and the likelihood of load loss

- A statistical sampling approach is used, to ensure the model focuses on tight periods

- Accounts for interconnection, so can look at LOLE in multiple countries simultaneously

- Unlike many adequacy modules, it simulates energy-limited storage solutions

- Can be run automatically after other simulations,

The LOLE module provides a robust way of assessing capacity adequacy, even given the complexities of interconnected countries and storage

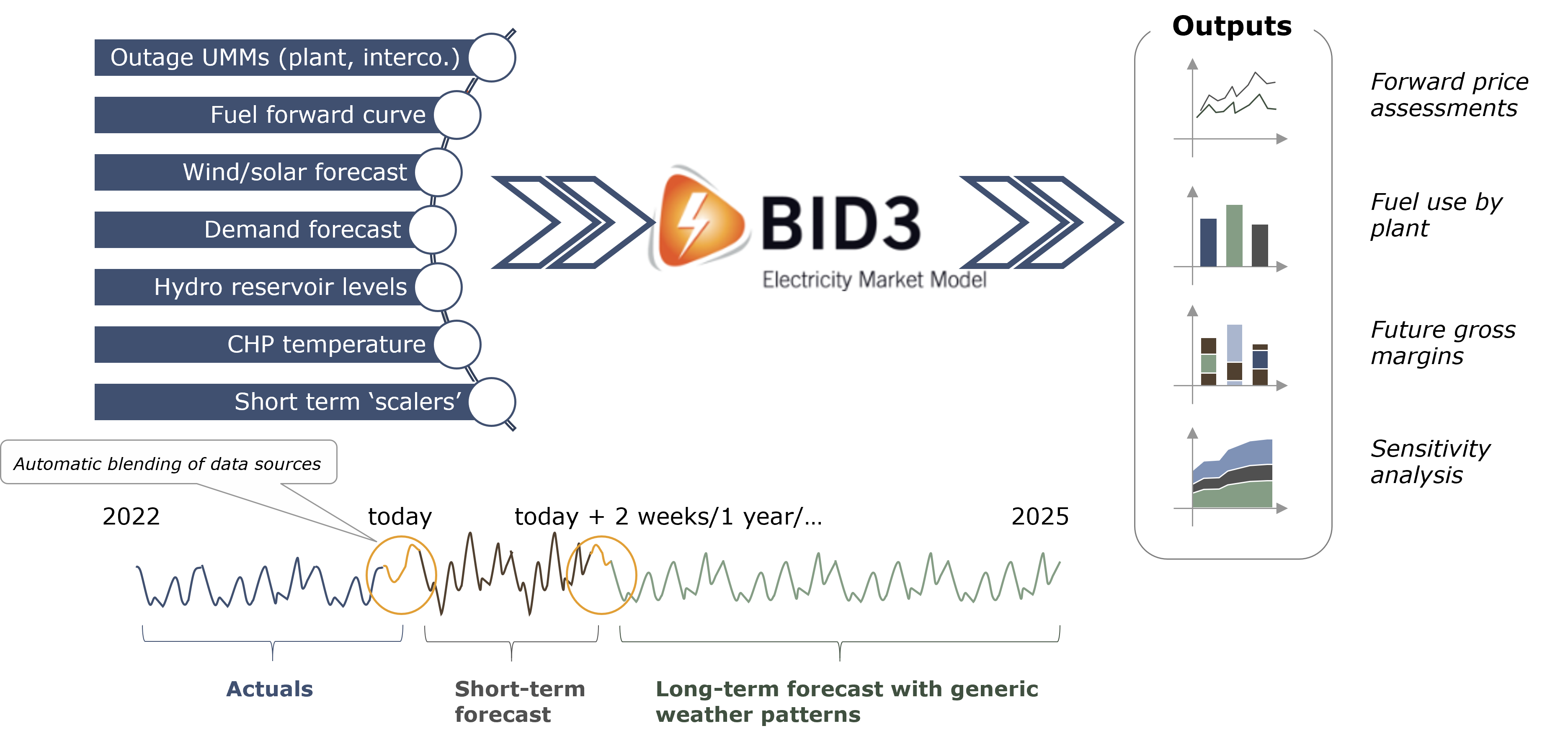

Using BID3 to simulate short-term markets is very powerful, allowing automated overnight runs to really understand the traded forward curves. Best of all, it ensures that the short-term and long-term simulations always stay harmonised

BID3 can automatically suck in data feeds, and run overnight (or more frequently). Come back into work in the morning with a set of hot-off-the-shelf runs, covering different scenarios and sensitivities

- Automatic ingestion of csv files of outage data, fuel prices, wind/solar forecasts, demand, hydro, temperature

- Use 'scalars' to adjust key variables

- Run a battery of different senstivities automatically overnight

- Ensure that your short-term modelling links seamlessly to your long-term scenarios

Not only do we get a fundamentals-based view of the forward curve, but also a wealth of supporting data, from fuel use to interconnector flows